Digital Product Passport Statistics: UK 2025

With the European Union’s Ecodesign for Sustainable Products Regulation ushering in the era of digital product passports (DPPs), UK businesses are under growing pressure to adapt. These regulations are designed to increase transparency, traceability, and sustainability across the product lifecycle and are reshaping how companies approach compliance, operations, and customer satisfaction.

To find out what 119,048 business leaders’ opinions in the UK thought about digital product passports, we used AI-driven audience profiling to synthesise insights from online discussions over a year, ending June 23rd, 2025, to a high statistical confidence level. This gave us a clear idea of how UK business leaders are responding to the shift, what they value most in digital product passport solutions, and the challenges and opportunities emerging as the regulation takes hold.

Index

- 21% of business leaders agree that marketing departments will benefit most from digital product passports

- 18% of business leaders are extremely excited about the greater sustainability that product transparency provides

- Operational clarity is the main reason 57% of business leaders are exploring digital product passports

- 32% see cost management as a major challenge for implementing digital product passports

- 51% of UK business leaders prefer online portals for sharing product passport data

- Business leaders report a 50/50 split between the distribution path and manufacturing processes needing more visibility in the product life cycle

- 43% say clear documentation would be most helpful in adopting digital product passport technology faster

- Local manufacturing, clear labelling, and recyclability top customer concerns for 66% of UK business leaders

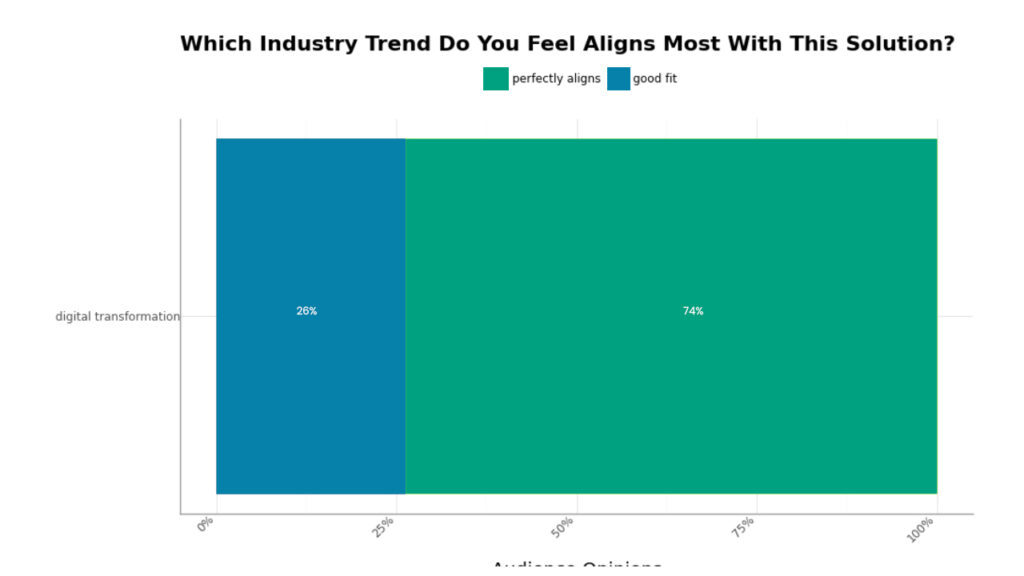

- 74% of business leaders say digital product passports perfectly align with digital transformation trends

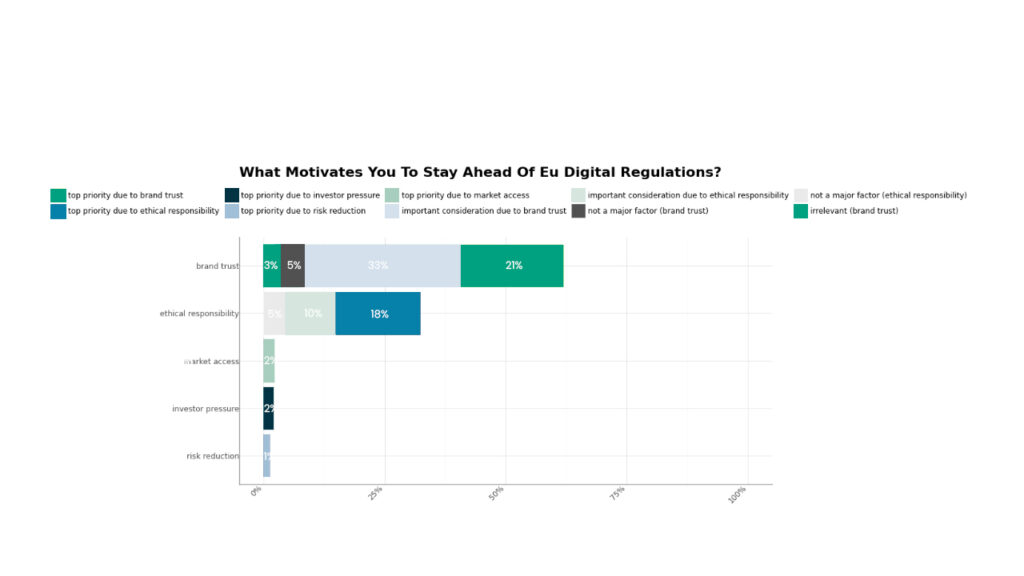

- Brand trust is the top priority motivating 33% of business leaders to stay ahead of EU regulations

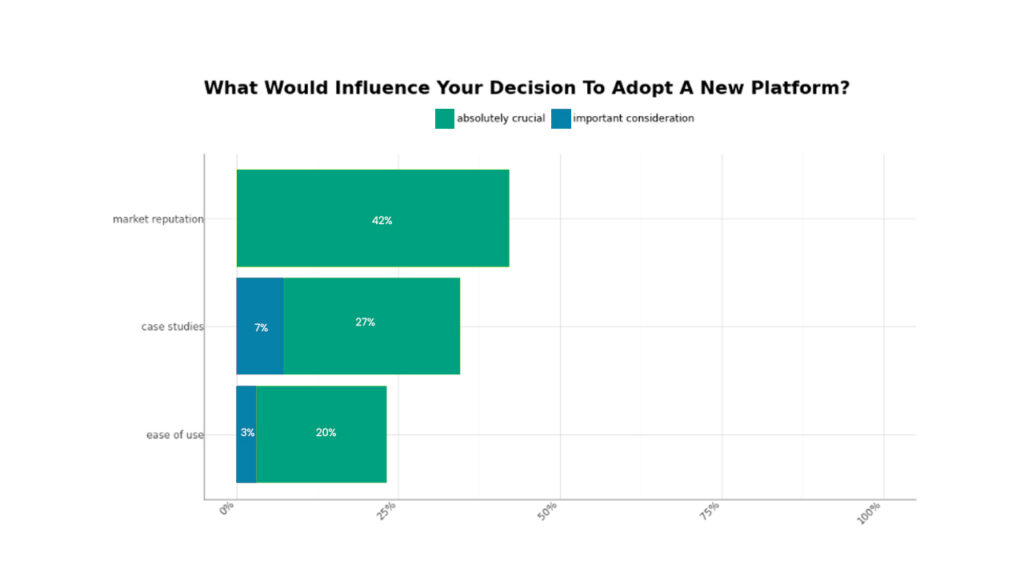

- 42% say market reputation is an absolutely crucial influencing factor when adopting a new digital product passport platform

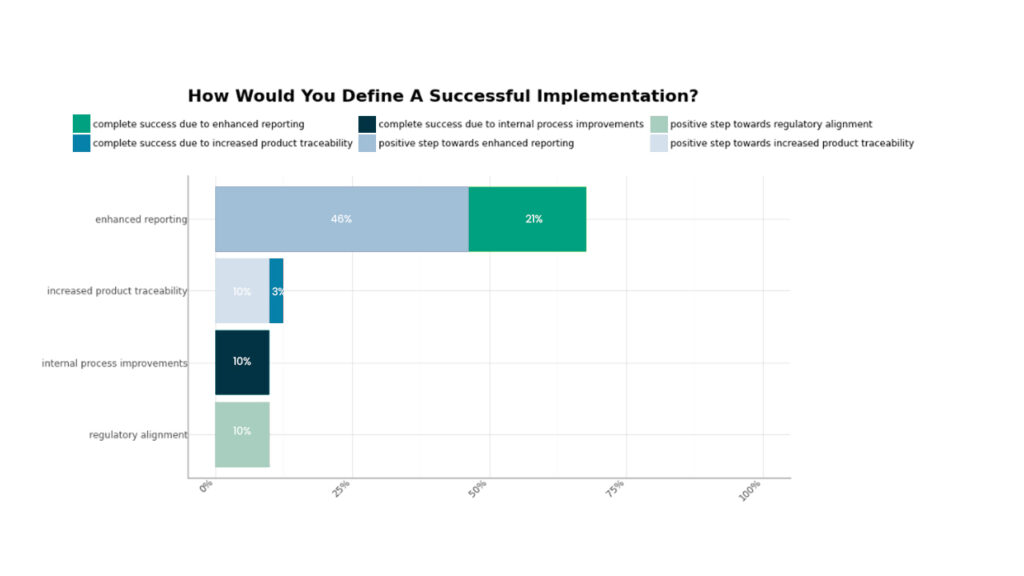

- 21% of business leaders define digital product passport implementation as a complete success due to enhanced reporting

- Methodology

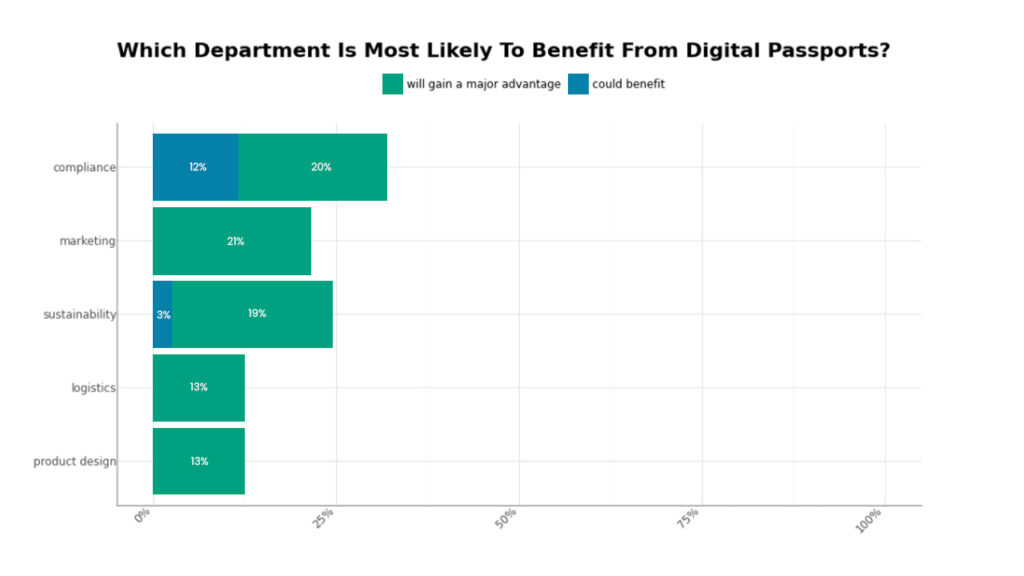

Which Department Is Most Likely To Benefit From Digital Product Passports?

21% of business leaders agree that marketing departments will benefit most from digital product passports

Five major departments will benefit from the implementation of DPPs:

Due to the new regulations, data from Grand View Research shows that the UK’s digital product passport market is expected to reach a projected revenue of £2543.3 million by 2030. Adoption of DPPs is clearly accelerating, and in doing so, it’s impacting every corner of business to varying degrees.

For our audience, marketing leads the way as the department most likely to benefit from digital product passports, with 21% of UK business leaders saying it will gain a major advantage. However, hot on marketing’s heels are the 20% who say compliance will gain a major advantage, and the 12% who agree this department could benefit. Close behind that are the 19% who say sustainability will benefit the most, followed by 3% who say this department could benefit. Both compliance and sustainability are core tenets of marketing, too, so this creates a cyclical effect.

Those who agree that logistics (13%) and product design (13%) will gain a major advantage may be lower in numbers, but they also highlight the important role digital product passports have in every department.

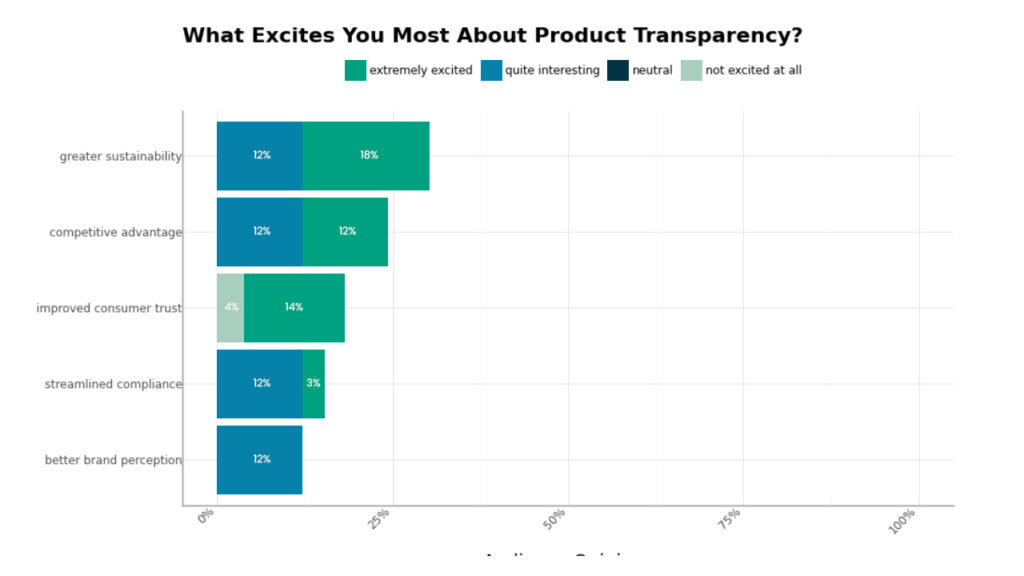

What Excites You Most About Product Transparency?

18% of business leaders are extremely excited about the greater sustainability that product transparency provides

Product transparency offers exciting opportunities in major business areas:

Product transparency makes it far easier to understand, explain, and trust how a product was made, what it contains, and the impact it has on people and the planet. This provides several exciting opportunities for business leaders in the UK, with 18% saying they are most excited about the greater sustainability product transparency offers, and 12% finding it quite interesting.

Sustainability can also provide a competitive advantage, with 42T’s Consumer Sustainability Report revealing that 57% of consumers believe sustainability gives brands a clear edge. For our audience, 24% are excited about this aspect of product transparency, with 12% saying they’re extremely excited and the other 12% saying it is quite interesting. 12% also say they find the better brand perception that product transparency offers to be quite interesting. Tying in with these factors is improved customer trust, of which 14% say they’re extremely excited, while just 4% are not excited at all.

For another 12% streamlined compliance is quite interesting, while 3% are extremely excited about this. Compliance also impacts sustainability, brand perception, and consumer trust, showing that leaders are recognising product transparency as a powerful catalyst for gaining a competitive edge on all levels.

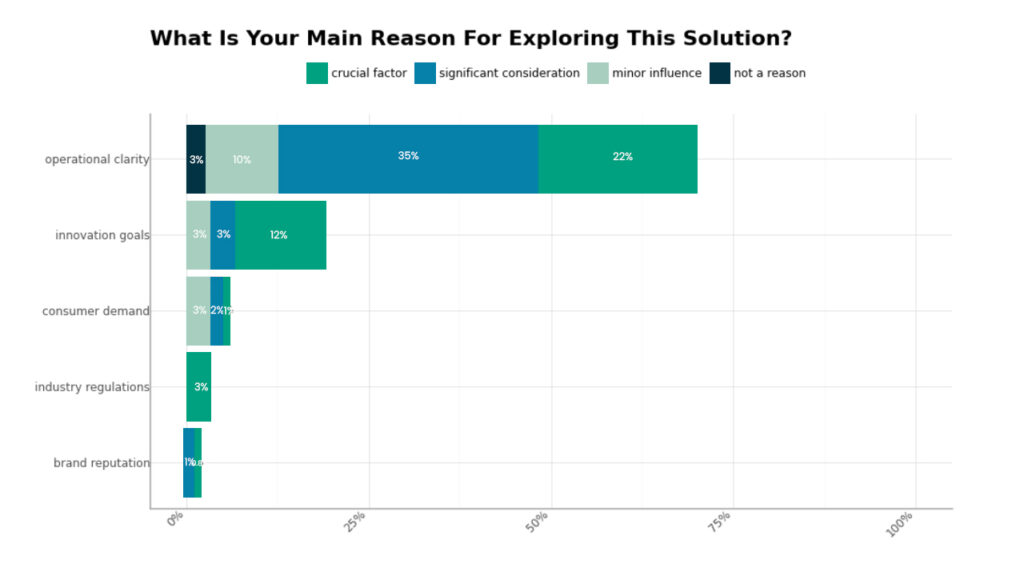

What Is Your Main Reason For Exploring Digital Product Passports?

Operational clarity is the main reason 57% of business leaders are exploring digital product passports

Reasons for exploring digital product passports differ quite dramatically:

Combined, 57% of UK business leaders say that operational clarity is the driving force behind them exploring digital product passport solutions. This 57% is split into 22% who say it’s a crucial factor and 35% who agree it is a significant consideration. An additional 10% also say it is a minor influence, while just 3% say it is not a reason. The same number (3%) cite industry regulations as their crucial factor for taking a closer look at these solutions.

In contrast, 12% say that innovation goals are a crucial factor, and 3% say they’re a significant consideration or have a minor influence. Despite the growing demand for sustainable products and reports showing that 66% of UK consumers take sustainability into account in their purchasing decisions, only 3% of business leaders say this demand has a minor influence, 2% say it’s a significant consideration, and 1% a crucial factor.

Brand reputation is also a reason for just 3%, of which 2% consider it a significant consideration and 1% a crucial factor. As a whole, this data shows the importance of operational clarity, which is understandable as this impacts all other areas of manufacturing, selling, and sustainability.

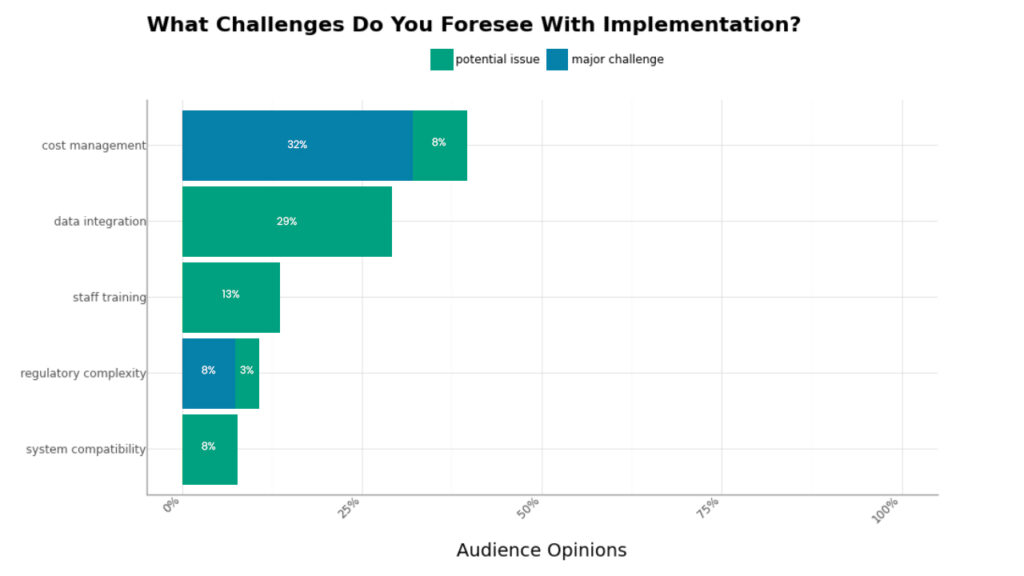

What Challenges Do You Foresee With Digital Product Passport Implementation?

32% see cost management as a major challenge for implementing digital product passports

Digital product passport implementation poses some challenges:

For our audience of UK business leaders, the biggest challenge in implementing digital product passports is cost management. 32% say it’s a major challenge, and 8% say it’s a potential one. Other potential issues are data integration (29%), staff training (13%), system compatibility (8%), and regulatory complexity (3%).

The remaining 8% say regulatory complexity is a major challenge, which is what 66% of attendees at a Chartered Institute of Export & International Trade webinar on the subject voiced concern over. The complexity of implementing the rules will impact every other challenge our audience foresees. However, cost remains the most immediate and tangible barrier, and is one often compounded by regulatory uncertainty, making strategic planning and resource allocation even more difficult.

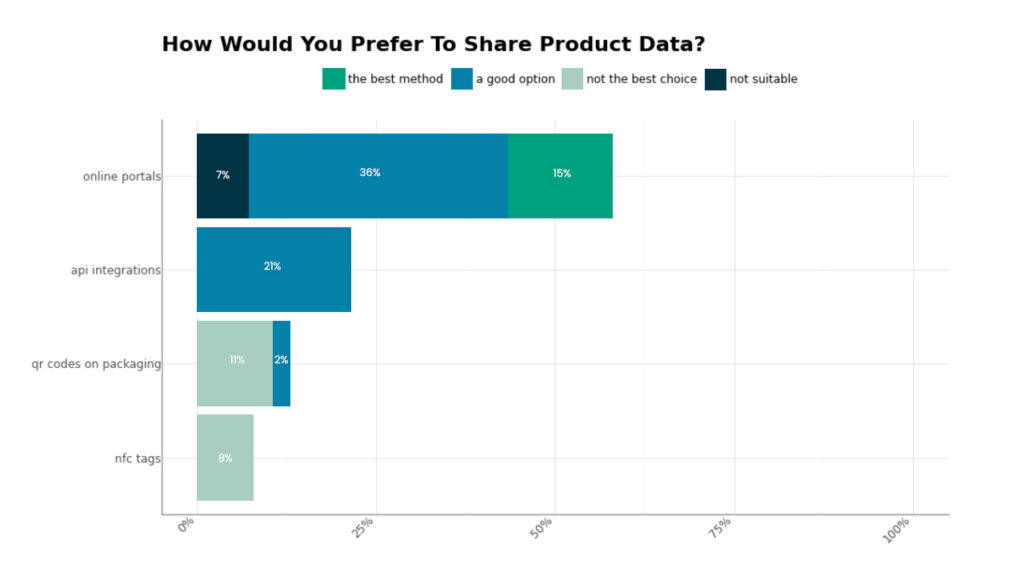

How Would You Prefer To Share Digital Product Passport Data?

51% of UK business leaders prefer online portals for sharing product passport data

The data shows clear preferences for product data sharing:

Considering the numerous data points a DPP can contain, it makes sense that the majority of our audience of UK business leaders would prefer to share product data via online portals. 15% agree it’s the best method, and 36% say it’s a good option.

However, surprisingly, 7% say it’s not suitable, which may indicate concerns around data security, usability, or the digital readiness of their current systems to handle the complexity of DPP requirements. Yet, 21% would prefer to share product data via API integrations, which also rely on robust digital infrastructure but offer greater automation, real-time updates, and smoother integration with existing enterprise systems.

QR codes on packaging and NFC tags are not the best choice for 11% and 8% respectively, while 2% say the former is a good option. These low numbers indicate that the general preference is digital.

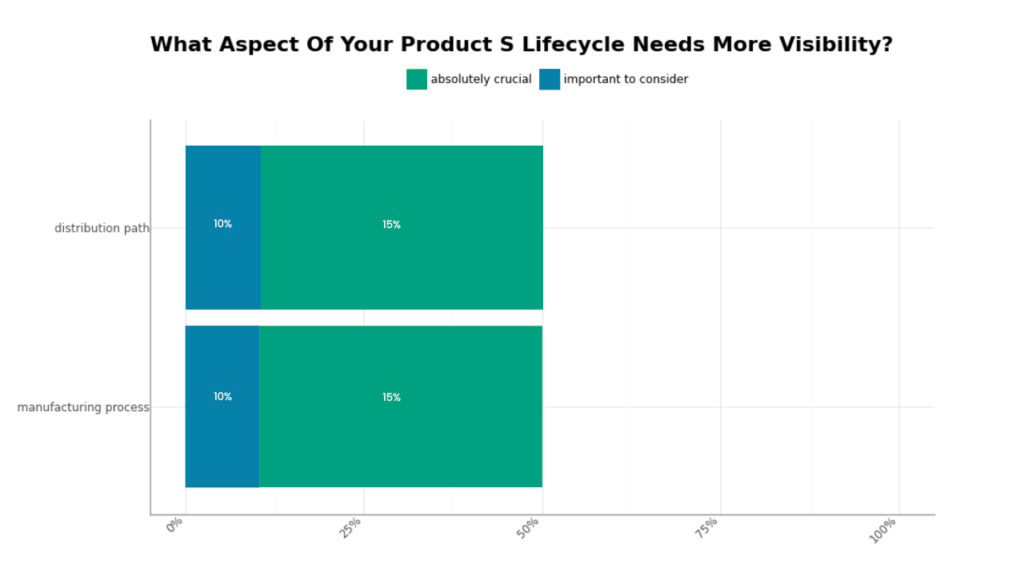

What Aspect Of Your Products Lifecycle Needs More Visibility?

Business leaders report a 50/50 split between the distribution path and manufacturing processes needing more visibility in the product lifecycle

Two main aspects of product life cycles require increased visibility:

There’s a very clear split between the 50% of business leaders in the UK who feel they need more visibility into the manufacturing process and the distribution path of their product life cycles. In both cases, 40% say that increased visibility in these areas is absolutely crucial, and 10% say it’s important to consider.

This signals that both manufacturing and distribution are equally vital blind spots that need additional transparency. If companies don’t have insight into their factory floors or the route a product takes from the manufacturer to the end customer, they risk product recalls, greenwashing accusations, and missed efficiency gains.

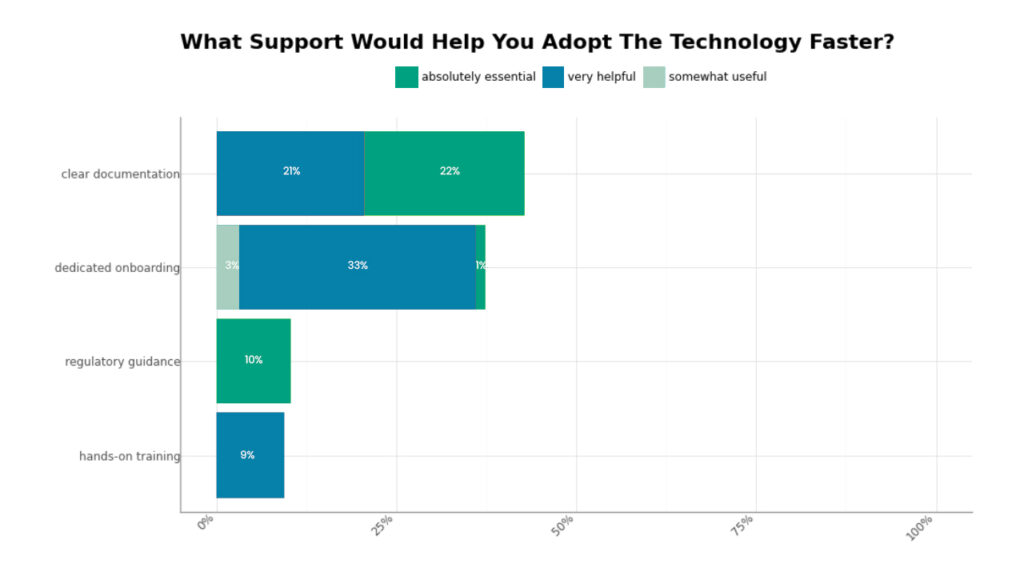

What Support Would Help You Adopt Digital Product Passport Technology Faster?

43% say clear documentation would be most helpful in adopting digital product passport technology faster

Various types of support would accelerate the adoption of digital passport technology:

With the European Union implementing the Ecodesign for Sustainable Products Regulation in 2024, the speedy adoption of digital product passports is essential to meet the subsequent deadlines. For our audience of UK business leaders, there are some forms of support that help more than others with this adoption, with clear documentation topping the list, with 22% saying it’s absolutely essential and 21% saying it’s very helpful. 33% felt the same about dedicated onboarding, while 1% said this was absolutely essential, and 3% somewhat useful.

Regulatory guidance (10%) and hands-on training (9%) were also on the list as being absolutely essential and very helpful, respectively, showing a need for clear compliance frameworks and practical skill development to support effective implementation.

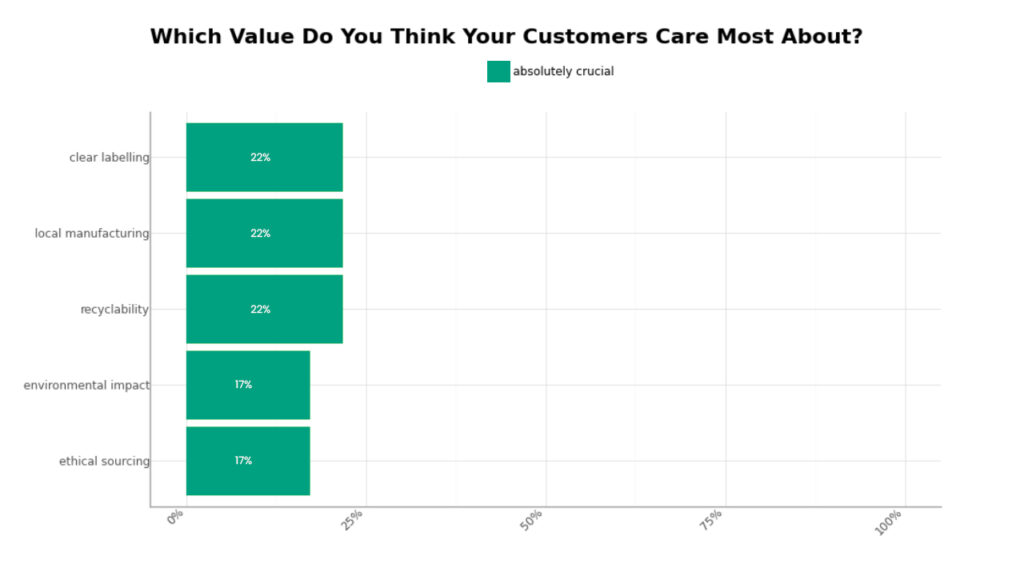

Which Value Do You Think Your Customers Care Most About?

Local manufacturing, clear labelling, and recyclability top customer concerns for 66% of UK business leaders

Opinions about what customers value most differ slightly across the board:

Customer values are crucial to success, with clear labelling, local manufacturing, and recyclability seen as absolutely critical by 22% of UK business leaders—more than those who prioritised environmental impact (17%) or ethical sourcing (17%).

This sentiment was echoed by consumers in a Make It British survey, where 69% said they’re now more likely to buy UK-made products post-Brexit and pandemic, even willing to pay up to 20% more for them.

Which Industry Trend Do You Feel Aligns Most With Digital Product Passports?

74% of business leaders say digital product passports perfectly align with digital transformation trends

Digital product passports and digital transformation trends go hand-in-hand:

Digital product passports embody the core goals of digital transformation by increasing transparency, improving data traceability, streamlining supply chains, and enhancing customer engagement.

It’s unsurprising, then, that 74% of our audience say that DPPs perfectly align with this trend, and 26% say it’s a good fit.

What Motivates You To Stay Ahead Of EU Digital Regulations?

Brand trust is the top priority motivating 33% of business leaders to stay ahead of EU regulations

EU digital regulations play a major role in business operations, and there are various motivations for staying ahead of them:

Studies show that 54% of consumers only buy from companies and brands they trust completely. This reinforces just how valuable brand trust is, and why 21% of our audience says that staying ahead of EU regulations is a top priority, due to this, and 33% say it’s an important consideration for the same reason. Conversely, just 3% say brand trust is irrelevant, and 5% say it’s not a major factor.

Ethical responsibility also ranks quite high,

with 18% saying it’s a top priority and 10% saying it’s an important consideration. Only 5% say it’s not a major factor.

At the bottom end of the list were those who were motivated to stay ahead of EU digital regulations due to market access (top priority for 2%), investor pressure (top priority for 2%), and the 1% who said it was a top priority due to risk reduction.

These statistics point clearly to the fact that brand trust and ethics are critical to how companies prioritise compliance with EU digital regulations, far outweighing other, more minor motivations.

What Would Influence Your Decision To Adopt A New Digital Product Passport Platform?

42% say market reputation is an absolutely crucial influencing factor when adopting a new digital product passport platform

The adoption of a new DPP platform is driven by some strong factors:

Our audience of UK business leaders knows exactly how important market reputation is, especially considering we’ve seen the value they place on brand trust. It’s understandable, then, that when looking to adopt a new digital product passport platform, market reputation would be absolutely crucial for 42%. This aligns with reports that show 83% of consumers would buy from companies with good reputations, but for our audience, there’s also a lot of power in proof of concept. 27% say case studies are an absolutely critical influence when considering the adoption of a new platform, and 7% say they are an important consideration.

Ease of use is also an influential factor, with 20% saying it’s absolutely critical and 3% saying it’s an important consideration. This suggests that, while good reputation and provable results lead the way, a platform still needs to be easy to use to really appeal to an organisation.

How Would You Define A Successful Digital Product Passport Implementation?

21% of business leaders define digital product passport implementation as a complete success due to enhanced reporting

The definition of success when implementing DPP relies on specific outcomes:

Measuring the success of digital product passport implementation is essential as it allows business leaders to ensure their systems are working correctly and are compliant with all regulations. For our audience, enhanced reporting is what defines a successful DPP implementation, with 21% saying it’s a complete success due to this and 46% saying it’s a positive step toward it.

Thereafter, the definition of successful implementation was split into 10% who said it was a complete success due to internal process improvements, 10% who said it showed a positive step toward regulatory alignment, and another 10% who agreed it was a positive step toward product traceability. 3% also cited this as a marker of complete success, highlighting the importance of being able to track a product through its lifecycle.

Overall, these findings reveal a clear shift in mindset among UK business leaders. From enhancing operational clarity and transparency to strengthening brand trust and aligning with digital transformation, digital product passports are impacting decisions across every department. As adoption accelerates, the businesses that act now stand to gain, not just in compliance, but in reputation, customer loyalty, and long-term resilience.

Methodology

This research was conducted by Push, sourcing an independent sample of 119,048 business leaders’ opinions in the UK across X, Reddit, TikTok, LinkedIn, Threads, and BlueSky. Results are derived from opinions expressed online, not actual questions answered by people in the sample.

About the representative sample:

- 46% of our audience of UK business leaders are between the ages of 45 and 64.

- 56% identify as male and 44% as female.